Feeling overwhelmed by retirement planning? Sandra DeLaRosa's Retirement Planning Guide for Beginners demystifies the process. This comprehensive guide breaks down complex financial jargon, helping you understand key concepts like 401(k)s, IRAs, and Social Security. Learn how to calculate your retirement needs, maximize your savings, and strategically invest, even with limited funds. Discover the power of compound interest and effective tax planning. The book debunks common myths and provides practical strategies for building wealth and securing a comfortable and stress-free retirement. Start planning your ideal future today – it's never too early, or too late, to begin.

Review Retirement Planning Guide for Beginners

This Retirement Planning Guide for Beginners resonated deeply with me, especially as someone in their early sixties who's finally tackling serious retirement planning. While I've absorbed bits and pieces of financial advice over the years, this book provided the cohesive structure and clear explanations I desperately needed. It's not just a dry recitation of facts and figures; it's a genuinely encouraging and supportive guide that gently nudges you toward action.

The friendly tone immediately put me at ease. The author, Sandra DeLaRosa, avoids overwhelming jargon, instead breaking down complex financial terms into easily digestible concepts. I particularly appreciated the early chapters focusing on planning and budgeting. These weren't just theoretical exercises; they offered practical strategies and tools I could immediately implement. For example, the detailed explanations of 401(k)s and IRAs were incredibly helpful, clarifying concepts I’d only vaguely understood before. Even with years of saving and investing under my belt, I found valuable new perspectives and strategies within these pages.

What truly sets this book apart is its ability to demystify the entire process. It effectively dismantles the misconception that retirement planning is solely for the wealthy or financially savvy. Instead, it empowers readers of all financial backgrounds, emphasizing that even small steps taken early can yield significant long-term results. The repeated emphasis on starting early and the power of compounding interest hit home, motivating me to take immediate action. Thanks to this book, I've finally set a concrete retirement date and established key milestones, such as paying off my house and becoming debt-free by that date. These weren't goals I had previously defined with such clarity.

The book also excels in addressing common anxieties surrounding retirement planning. It doesn't shy away from acknowledging the fear and uncertainty many people experience, offering reassurance and a practical roadmap to navigate those feelings. The sections on maximizing social security benefits, estate planning, and even healthcare and long-term care planning were particularly valuable, covering crucial aspects often overlooked. It’s a holistic approach, encompassing not just investments but also the broader picture of securing a comfortable and stress-free retirement.

Beyond the practical advice, the book's motivational element is equally impressive. It cultivates a positive and confident mindset, encouraging readers to take control of their financial future. It’s not just about accumulating wealth; it's about building a secure foundation for a fulfilling and enjoyable retirement – a retirement filled with leisure, hobbies, and time with loved ones, as the book so eloquently promises. This focus on peace of mind is what ultimately makes this book such a valuable resource. It's a handbook, a mentor, and a cheerleader all rolled into one. It's the perfect blend of technical expertise and emotional support, guiding you through the process with empathy and encouragement. I wholeheartedly recommend this book to anyone, regardless of age or financial knowledge, who is serious about securing a brighter and more comfortable future. My future self is already thanking me for reading it.

Information

- Dimensions: 5.5 x 0.33 x 8.5 inches

- Language: English

- Print length: 144

- Publication date: 2024

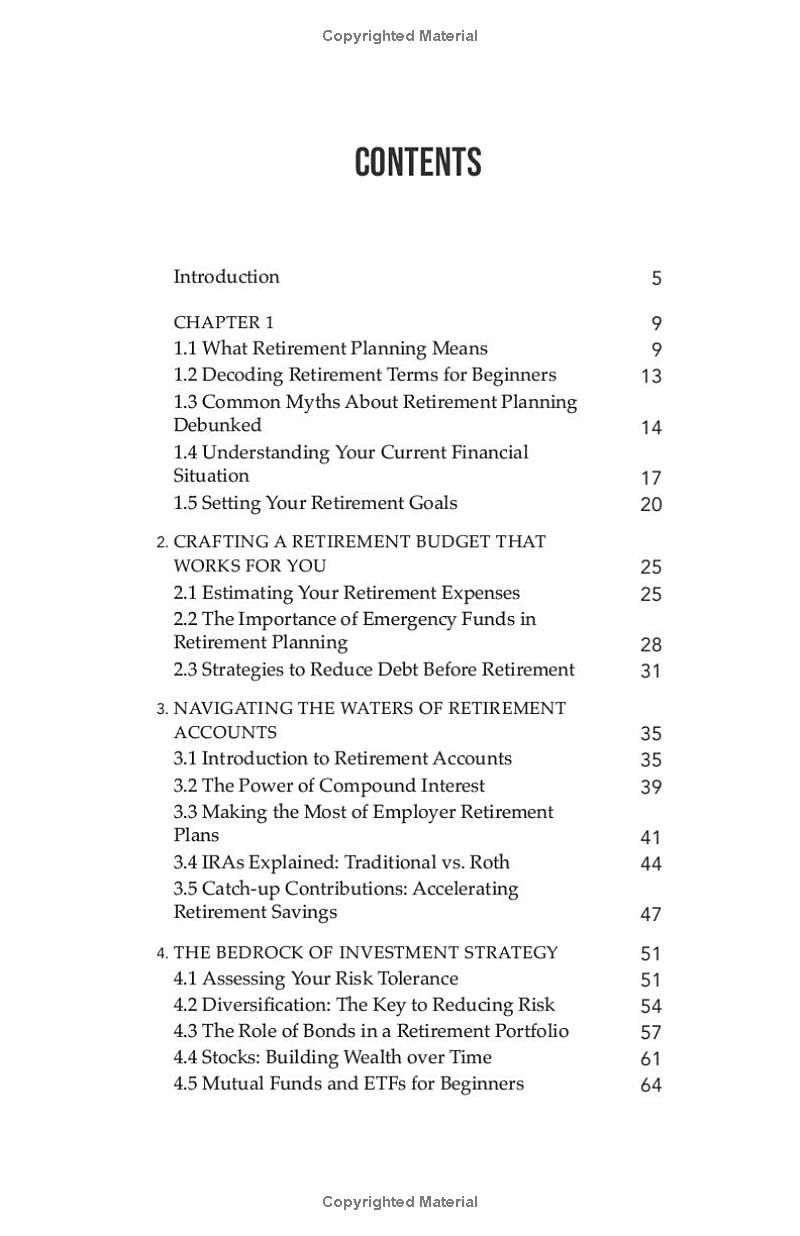

Book table of contents

- Introduction

- CHAPTER 1

- CHAPTER 2

- CHAPTER 3

- CHAPTER 4

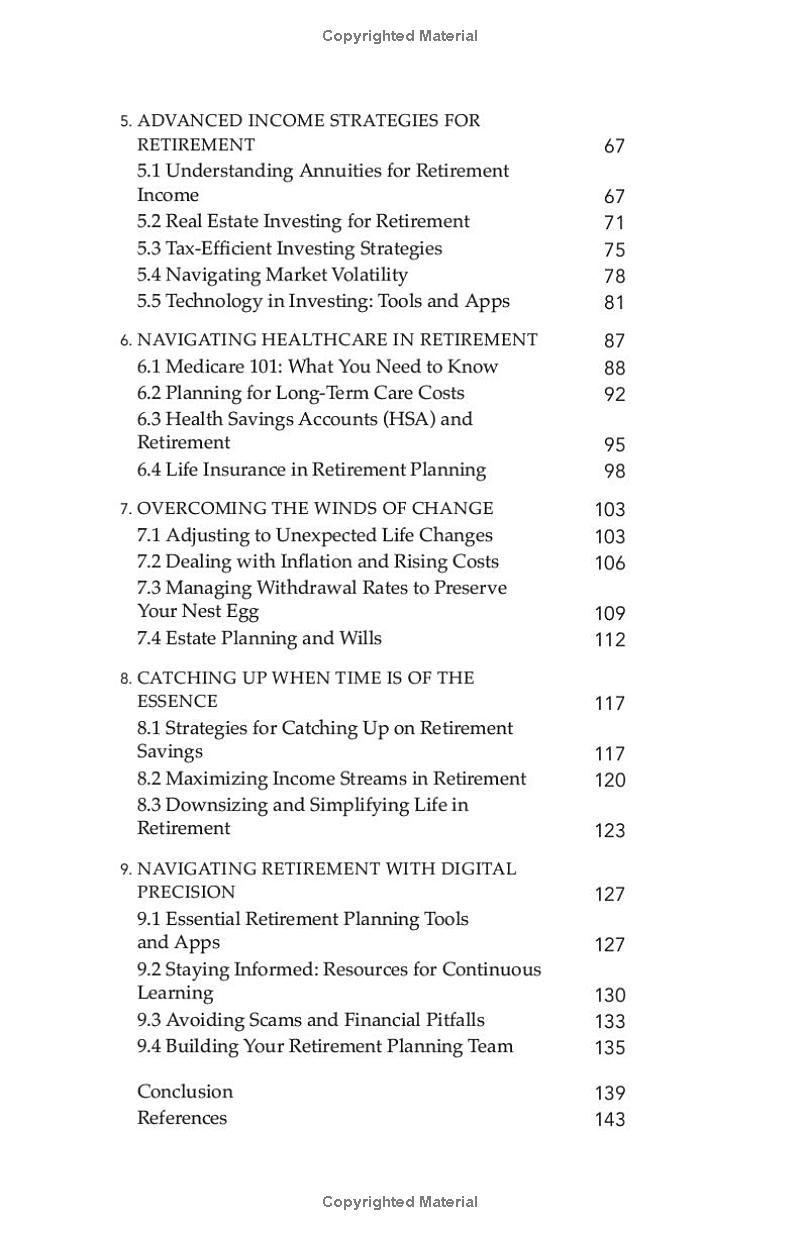

- ADVANCED INCOME STRATEGIES FOR RETIREMENT

- NAVIGATING HEALTHCARE IN RETIREMENT

- OVERCOMING THE WINDS OF CHANGE

- CATCHING UP WHEN TIME IS OF THE ESSENCE

- NAVIGATING RETIREMENT WITH DIGITAL PRECISION

- Conclusion

- References

Preview Book